Supply and Demand Principles in Cryptocurrency Markets

The world of cryptocurrency has experienced rapid growth over the past decade, with many investors and traders flocking to digital currencies such as Bitcoin (BTC), Ethereum (ETH), and others. However, beneath the surface of this market lies a complex interplay of supply and demand principles that can significantly impact its price movements.

What are Supply and Demand Principles?

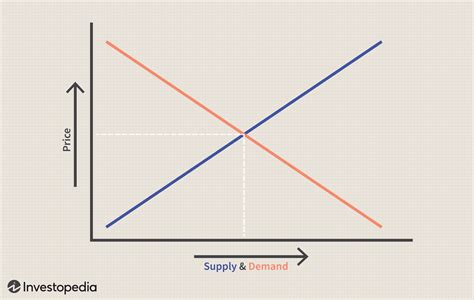

Supply and demand principles refer to the underlying forces that drive the prices of goods and services in an economy. In the context of cryptocurrency markets, these principles manifest themselves in various ways, shaping the dynamics of buying and selling. Understanding these concepts is crucial for investors, traders, and market participants to navigate the complex world of cryptocurrencies.

The Supply Side: Central Banks and Institutional Investors

One of the primary drivers of price movements in cryptocurrency markets is the supply side, which involves central banks and institutional investors entering the market with a significant amount of capital. This influx of new players can lead to increased demand for digital currencies, driving up prices. For example, when a major central bank such as the US Federal Reserve or the European Central Bank announces plans to launch a cryptocurrency-backed stablecoin, it sends shockwaves through the market, causing price increases.

The Demand Side: Individual Investors and Adoption

The other side of the coin is the demand side, which consists of individual investors, enthusiasts, and potential adopters. As more people become aware of cryptocurrencies and their potential benefits, demand for digital currencies increases, driving up prices. This trend has been particularly pronounced in recent years as cryptocurrency adoption has expanded across various segments of society, including millennials, women, and small business owners.

Price Volatility: A Result of Supply and Demand Imbalance

The intersection of supply and demand principles can lead to significant price volatility in cryptocurrency markets. When there is an imbalance between the number of buyers and sellers, prices tend to fluctuate wildly. This imbalance can arise from various factors, including:

- Increased adoption: As more people become aware of cryptocurrencies, demand increases, leading to higher prices.

- Central bank involvement: Central banks may introduce new currencies or stablecoins, which can attract investors and drive up prices.

- Market sentiment: Changes in market sentiment, such as optimism or pessimism, can influence price movements.

Examples of Supply and Demand Imbalance

Several notable examples demonstrate the impact of supply and demand principles on cryptocurrency markets:

- Bitcoin (BTC): In 2017, Bitcoin experienced a significant price surge due to increased adoption by institutional investors, such as Square (SQ) and MicroStrategy’s investment in BTC.

- Ethereum (ETH): During the 2020 Ethereum Upgrade 2.0 launch event, ETH prices surged as more developers began to build on its ecosystem, driving up demand for the cryptocurrency.

- Litecoin (LTC): In May 2018, Litecoin experienced a price surge due to increased adoption by Chinese investors, particularly after China’s central bank announced plans to explore digital currencies.

Conclusion

The supply and demand principles in cryptocurrency markets can have a significant impact on prices, leading to periods of extreme volatility. As the market continues to evolve, it is essential for investors, traders, and market participants to stay informed about these underlying forces. By understanding how supply and demand principles interact, individuals can better navigate the complex world of cryptocurrencies and make more informed investment decisions.